Common AR Scenarios in Healthcare and How To Address Them (AR Calling Scripts Included!)

Explore key challenges in the medical billing AR scenarios and discover practical solutions to enhance efficiency. Read the article for actionable insights.

November 7, 2025

Key Takeaways:

• AR days measure how long it takes to collect revenue; lowering AR days frees working capital and improves liquidity.

• Top AR issues are denials, underpayments, eligibility/COB errors, documentation gaps, timely-filing misses, and aged/unresolved claims.

• Proactive denial management prevents revenue leakage and reduces rework.

• Automate eligibility checks, claim scrubbing, and underpayment detection to catch problems before submission.

• Train staff, run regular audits, and use caller scripts to improve collections and maintain coding/compliance accuracy.

• Treat AR as a strategic discipline—use daily dashboards and AI analytics to turn trapped receivables into predictable cash flow.

Even if your billing team is working hard, your cash might still be trapped in AR.

Across hospitals and healthcare providers' groups, the story is the same: revenue earned on paper, but not in the bank. Denials stack up, underpayments slip through, and “days in AR” quietly become the most expensive number on the balance sheet.

That's because most healthcare organizations lack visibility into their AR systems. They know what’s billed, but not what’s blocked—where cash is stuck, why it’s delayed, and how much it’s silently leaking every month.

That's why it's crucial for RCM leaders to treat AR management as a strategic discipline. This involves analyzing the most common AR scenarios in medical billing that impact collections, uncovering hidden revenue leaks, and designing workflows that keep cash moving faster.

So, let's start with the basics and later dive into AR denial management scenarios in medical billing.

What Is AR in Medical Billing?

AR in medical billing stands for Accounts Receivable, which reflects outstanding payments after services in a healthcare organization are billed and rendered to a patient. These payments come from three sources: insurance companies, government payers (Medicare and Medicaid), and patients themselves.

And it all boils down to AR management.

Ideally, days in AR should be as low as 40 days to ensure strong cash flow and efficient revenue recovery.

.webp)

Why Does AR Management Matter In RCM?

When AR is managed effectively, healthcare organizations can process claims promptly, minimize denials, and get healthy cash flow. However, when AR is neglected, the result is delayed reimbursements, increased write-offs, and financial instability.

Consider this AR scenario:

A mid-sized hospital with $150 million in annual charges (about $410,000 in daily charges) managing AR at 50 days holds approximately $20.5 million in outstanding accounts receivable.

If that same hospital reduces AR to 40 days through improved denial management, automation, and faster follow-up, it can potentially free up $4.1 million in working capital immediately.

Sounds like a lot of cash sitting on the sidelines, doesn’t it?

That’s the reality for many hospitals managing bloated AR. But the good news is that most of them are fixable with the right denial management and follow-up strategy.

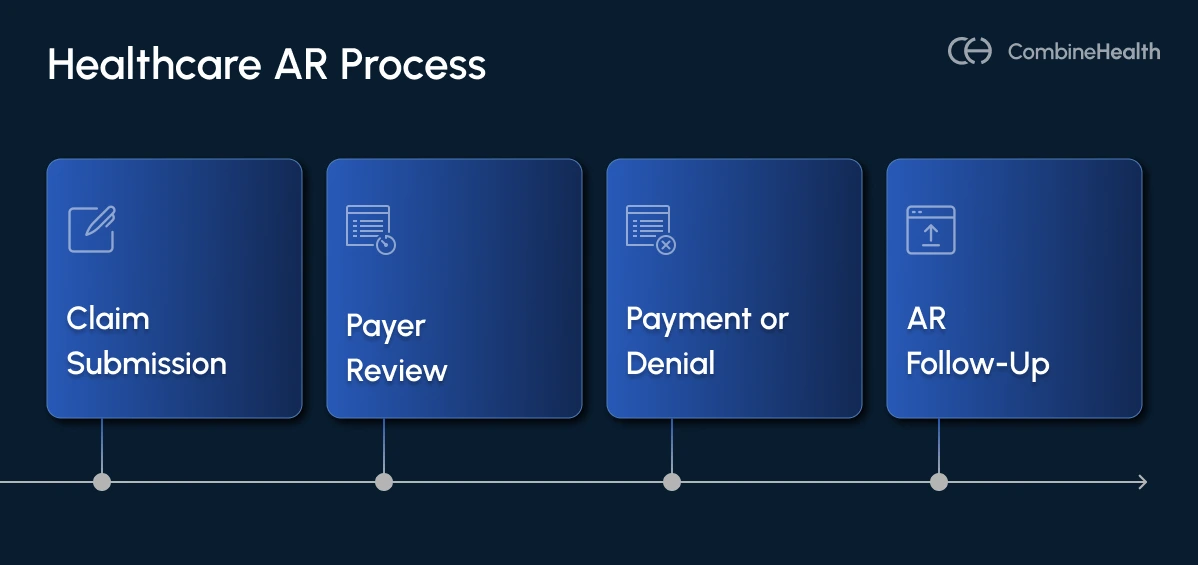

How Does the Accounts Receivable Process Work in Healthcare?

The AR process in healthcare typically involves five major stages:

- Claim Submission: Claims are sent to payers after coding and billing.

- Payer Review: The insurance company verifies coverage, coding accuracy, and eligibility.

- Payment or Denial: The payer either pays, partially pays, or denies the claim.

- AR Follow-Up: The AR team follows up on unpaid or denied claims, appeals the claims if necessary, and posts payments.

- AR Notes: The AR team maintains a record of all actions, communications, findings, and decisions related to outstanding insurance claims, denied claims, patient balances, and payer follow-ups.

Check out this AR calling notes template to use for your next AR denial scenarios.

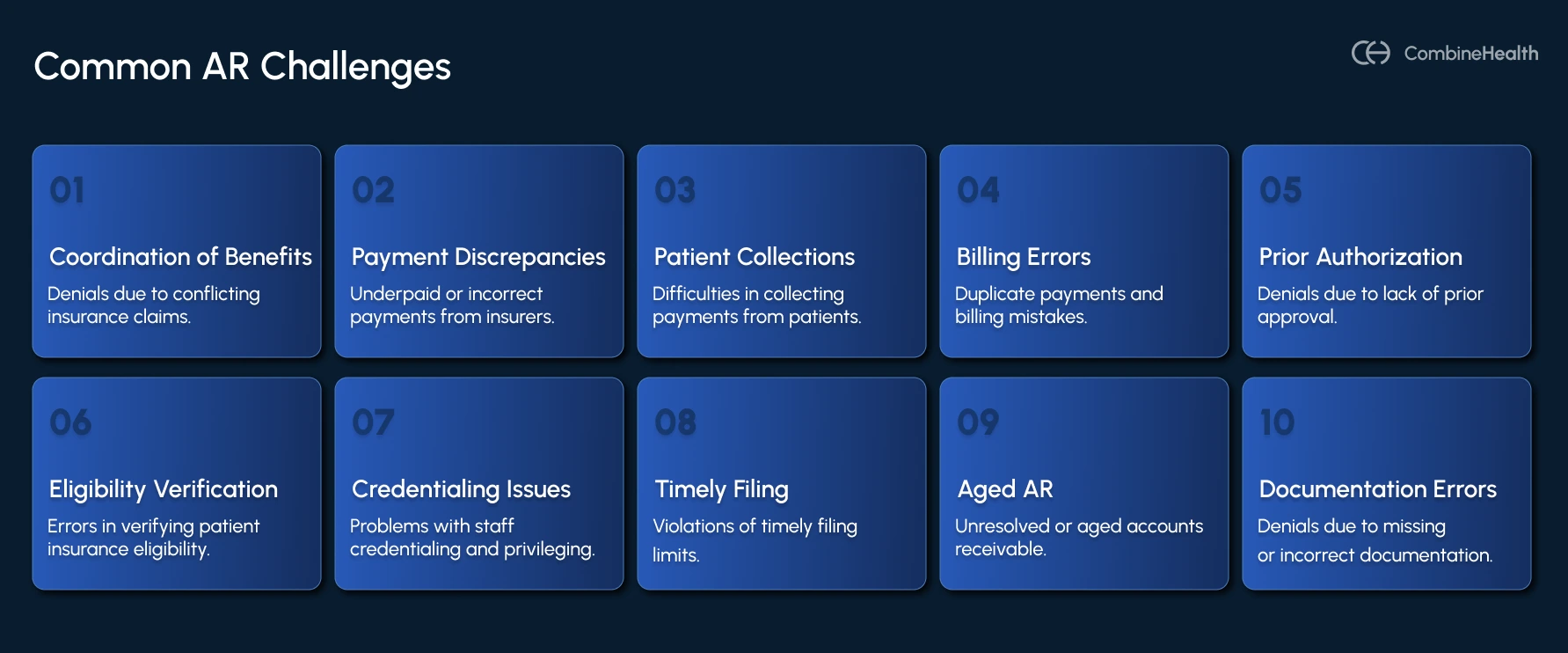

Top 10 Common AR Scenarios in Medical Billing

Here are the 10 most common AR scenarios that show up most often and how billing teams must handle them strategically:

AR Scenario 1: Coordination of Benefits (COB) Related Denials

COB-related denials occur when patients have multiple insurance plans (e.g., employer + spouse plan), and the wrong payer is billed as primary.

Steps to address this AR denial:

- Review the Explanation of Benefits (EOB) or electronic remittance notice for denial codes and confirm whether the payer is indicating “Other coverage primary.”

- Call the patient to verify any recent insurance changes (job change, new spouse plan, Medicare enrollment).

- Contact each payer to confirm which plan is primary under COB rules (e.g., birthday rule, Medicare secondary payer rules).

- Correct the primary/secondary order in the patient’s insurance profile and ensure your medical billing staff and eligibility systems reflect the change before rebilling.

- Once processed, attach the primary EOB when submitting to the secondary payer. Include documentation explaining the correction to prevent duplicate claim denials.

A/R Calling Script Example:

“Hello, I’m calling to confirm the Coordination of Benefits for [Patient Name]. Could you please confirm which plan was primary on [Date of Service] and the effective dates of each policy?”

AR Scenario 2: Claim Underpaid/Incorrect Payment

Underpayments occur when the payer reimburses below the contracted rate due to contract discrepancies, DRG mismatches, or downcoding.

Recommended Reading: Differences between upcoding and downcoding in medical billing

Steps to address this AR denial:

- Use payment-posting automation or contract-management software to flag payments below the expected allowable

- Review the provider’s contract fee schedule and confirm the expected rate for each CPT code.

- Obtain the EOB, payer remittance, and any medical records required for appeal.

- File a Payment Discrepancy Appeal within the payer’s timeline (often 30–60 days).

- If underpayment recurs, escalate to the payer contract representative or provider relations.

A/R Calling Script Example:

“We received payment for claim [ID], but it appears underpaid. Could you confirm the allowed amount per your contract and explain any adjustments made?”

AR Scenario 3: Patient Payment Collection Challenges

Collecting patient balances can be challenging, particularly with high-deductible health plans. Most patients now bear more costs via deductibles, copayments, and coinsurance due to insurance design changes. Despite higher patient balances, commercially insured patient collection rates have fallen to nearly 48%.

While this shift was designed to reduce payer burden, it has created significant cash flow strain for healthcare providers. Even when claims are processed correctly and paid by insurance, the patient portion often remains unpaid for weeks or months.

That's why the most effective way to reduce days in accounts receivable is by practicing point-of-service collections. Additionally, providing patients with accurate cost estimates before treatment helps manage their financial responsibilities under high-deductible health plans.

Steps to address this AR denial:

- Collect co-payments, deductibles, and self-pay balances up-front whenever possible.

- Establish a written patient responsibility and collections policy as part of your practice compliance plan.

- Providing patients with accurate cost estimates before treatment helps manage their financial responsibilities under high-deductible health plans.

- Follow a structured communication cadence, eg, after payer adjudication, 15–20 days later, and after 45–60 days.

- Before turning an account over to a collection agency, send a final notice.

- When internal efforts are exhausted, partner with a reputable collection agency that specializes in healthcare accounts.

Note: Healthcare providers can offer flexible payment options to accommodate patients with financial constraints. In addition, transparent communication about payment policies and patient responsibilities during the registration process is essential.

A/R Calling Script Example:

“Hi [Patient Name], we noticed a remaining balance of [$X] from your visit on [Date]. We can help you set up a payment plan today. Would you like to take care of it over the phone or online?”

AR Scenario 4: Duplicate Payments and Billing Error

Duplicate billing and payment errors can be costly. They happen when a claim is submitted more than once for the same service, or when both a payer and patient remit for the same balance. In other cases, a payer may process the same claim twice, creating an overpayment that later triggers refund demands or audits.

Additionally, coding errors lead to claim denials due to incorrect or outdated diagnosis or procedure codes.

Typical root causes include:

- Claims submitted before a response is received from the clearinghouse

- Manual re-entry of charges after system downtime

- Posting errors by staff unaware of prior payment

- Lack of internal reconciliation between billing and bank deposits

Steps to address this AR denial:

- Review remittance advice and compare payment dates, CPT codes, and check/EFT numbers.

- Confirm whether both claims share the same control number or were filed under different IDs

- Cross-check remittances against bank deposits and your EHR ledger.

- If overpayment was made by the payer, report it immediately.

- Follow compliance protocols under CMS and OIG guidelines, which require refunding payer overpayments within 60 days of identification.

A/R Calling Script Example:

“Hello, I’m calling regarding claim [ID]. We received two payments — one on [Date 1] and another on [Date 2] — for the same service. Could you confirm whether both payments were issued intentionally or if one was a system duplicate?”

AR Scenario 5: Prior Authorization Claim Denials

Insurance coverage issues, such as policy expirations or lack of prior authorization (PA), are common causes of claim denials. However, PA comes under the preventable denial categories in the healthcare billing process. It ensures that payers approve medical necessity before a service is rendered.

Some common causes are:

- Authorization not obtained or expired before the procedure

- Authorization obtained for an incorrect CPT or diagnosis code

- Staff unaware of payer-specific PA requirements

- Authorization numbers not included in the submitted claim

Steps to address this AR denial:

- Check denial codes and review the EOB for the service line that triggered the denial.

- Verify whether the service did indeed require prior authorization.

- Obtain medical necessity documentation and clinical notes from the provider.

- File a retroactive authorization request (if eligible) or an appeal citing “medical necessity.”

Recommended Reading: Expert's insight on building a smarter prior authorization process

A/R Calling Script Example:

“Hi, this is [Name] from [Practice]. I’m calling regarding claim [ID] for [Patient Name]. It was denied for missing authorization. Could you please confirm if retro-authorization is possible for CPT [XXXX] on [Date of Service], and what documentation you require?”

AR Scenario 6: Insurance Eligibility Verification Errors

Eligibility and coverage errors occur when patient insurance information is outdated, inactive, or incorrectly entered in the billing system.

Steps to address this AR denial:

- Verify eligibility retroactively using the clearinghouse or payer portals and confirm active coverage for the date of service.

- Update payer ID, plan type, group number, and policyholder information in the EHR.

- Submit a corrected claim with updated information.

- If no active insurance was found, communicate responsibility clearly to the patient and offer payment plans.

A/R Calling Script Example:

“I’m calling to verify eligibility for [Patient Name] on [Date of Service]. Could you please confirm active coverage, plan type, and the correct payer ID so we can process the claim accurately?”

AR Scenario 7: Credentialing and Privileging Issues

Credentialing and privileging errors occur when a provider is not properly enrolled with a payer or when credentials have expired. These claim denial scenarios are frequent during new provider onboarding or payer transitions and can lead to claim rejections for affected NPIs.

Steps to address this AR denial:

- Identify the cause of claim denial and verify whether the provider’s credentialing or revalidation is pending.

- Confirm enrollment status and effective date of participation.

- If incomplete, send updated forms, licenses, or malpractice certificates.

- Check if the payer allows rebilling under a group NPI if the rendering provider is part of that entity.

- Maintain a credentialing log with expiration and revalidation alerts.

A/R Calling Script Example:

“We received a denial for claim [ID] stating the provider is not credentialed. Could you confirm the credentialing status and effective participation date for [Provider Name]?”

AR Scenario 8: Timely Filing Limit Violations

Every insurance payer enforces a timely filing limit — the maximum number of days after the date of service (DOS) a claim can be submitted. For example:

- Medicare: 12 months from DOS

- Commercial payers: 90–180 days

- Medicaid (varies by state): 180–365 days

Once that deadline passes, the claim is automatically denied, even if every other detail is correct. These claim denials are non-recoverable unless you can provide documented proof that the claim was initially submitted on time but delayed by a payer or clearinghouse error.

Steps to address this AR denial:

- Verify the payer’s filing limit and appeal rules, and see if exceptions apply.

- Search your clearinghouse logs for the original submission date and confirmation number.

- If the claim was rejected, locate the rejection notice to show a timely attempt.

- Include evidence such as clearinghouse acceptance reports, fax confirmations, or EDI receipts.

- Update the claim notes with the appeal reference number and submission proof.

A/R Calling Script Example:

“Hello, I’m following up on claim [ID] for [Patient Name]. It was denied for timely filing, but we have proof it was submitted through our clearinghouse on [Date]. Could you confirm your system’s recorded receipt date and whether reconsideration is possible?”

AR Scenario 9: Unresolved or Aged AR

Aged A/R, i.e., claims sitting unpaid for 60, 90, or 120+ days, is the clearest signal of inefficient follow-up and revenue leakage in healthcare medical billing. In fact, A/R aging is one of the first metrics CFOs monitor monthly because it directly reflects the organization’s liquidity and operational discipline.

Steps to address this AR denial:

- Generate a comprehensive A/R aging report and segment by payer, dollar value, and claim age.

- Identify if claims are delayed due to payer issues, claim denials, missing documentation, or no follow-up.

- Set follow-up frequency (every 10–14 days) until payment or final disposition.

- Ask for escalation to a supervisor for claims over 90 days with no update.

A/R Calling Script Example:

“Hi, this is [Name] from [Practice]. I’m following up on claim [ID] submitted on [Date]. Could you confirm its current processing status and whether any additional documentation is required for payment?”

AR Scenario 10: Claim Denied Due to Missing or Incorrect Documentation

Clinical documentation-related denial scenarios occur when a claim is missing supporting records, attachments, or accurate coding required to justify the billed service.

Typical causes include:

- Missing medical records or operative reports.

- Illegible or incomplete clinical documentation.

- Missing modifiers, coding errors, or diagnosis-to-procedure mismatch.

- Failure to attach required documentation (e.g., medical necessity letter, prior auth, or signed chart).

Recommended Reading: E&M coding guide for 2025

Steps to address this AR denial:

- Check payer remarks specifying missing data or coding errors.

- Obtain missing chart notes, operative reports, or test results from healthcare providers.

- Ensure documents are signed, dated, and legible.

- Review CPT and ICD-10 coding for accuracy and add missing modifiers (e.g., -25, -59) when justified.

- Submit corrected claim through the appropriate channel (fax, EDI, or payer portal).

A/R Calling Script Example:

“We received a denial for claim [ID] stating documentation was missing. Could you specify which records are required so we can submit them promptly for review?”

Why RCM Leaders and CFOs Must Prioritize AR Management

In a healthcare environment defined by razor-thin margins, rising payer complexity, and shifting reimbursement models, CFOs and RCM leaders need to treat AR as a core growth function. Here's what effective AR management helps with:

1. Cash Flow Improvement and Operational Liquidity

At its core, AR management is cash flow management, and AR days directly measure the financial pulse of a healthcare organization.

When AR days climb above 50, liquidity tightens.

- Payroll and staffing budgets get squeezed

- Supply chains for medications and surgical equipment stall

- Utility and facility costs face deferrals

- Debt servicing requires short-term borrowing at premium rates

These ripple effects can undermine even the strongest balance sheets.

Conversely, when AR days drop below 40, cash moves faster, and organizations gain the freedom to reinvest in clinical excellence, technology upgrades, and patient services.

2. Revenue Leakage Prevention and Recovery

Revenue leakage occurs when delivered services go unpaid due to denials, underpayments, or missed follow-ups. Once claims age:

- Bills over 120 days recover just a few cents on the dollar.

- Each additional day unpaid decreases the probability of full recovery.

- Write-offs from uncollected balances erode margins and distort financial forecasts.

3. Strategic Decision-Making and Operational Intelligence

AR data is a goldmine for strategic finance leaders. Modern CFOs and RCM directors use AR analytics to drive smarter decisions about staffing, payer contracts, and investment priorities.

Daily AR monitoring reveals:

- Denial patterns by payer or specialty

- Aging buckets and their financial impact

- Trends in patient self-pay collections

- Payer turnaround times and bottlenecks

- Cash forecasting accuracy

This level of transparency gives leadership the agility to act on leading indicators, not lagging reports.

AI-driven automation can significantly enhance coding accuracy and reduce administrative burdens in AR management.

Recommended Reading: How AI is used in the RCM processes and how it is different from automation

4. Regulatory Compliance and Risk Mitigation

Inaccurate AR records can trigger audit failures, repayment demands, or payer sanctions.

Robust AR management minimizes these risks and helps with:

- Ensuring all AR transactions are auditable and traceable

- Promoting timely reporting aligned with CMS and payer regulations

- Supporting HIPAA and OIG compliance through access control and fraud monitoring

- Enabling AI-based anomaly detection to flag suspicious transactions or overpayments

AR Denial Management Process in Medical Billing

Effective AR denial management is about shifting from chasing denial scenarios to preventing them, using data, automation, and process discipline. And to reduce AR denial rates, healthcare providers should implement a structured denial management process.

.webp)

Here's how you can optimize your AR denial management process:

Step 1: Adopt a “First Pass Resolution” Culture

Focus teams on clean claim submission rather than post-denial firefighting.

Implementing preventive measures, such as regular audits, helps in reducing the frequency of AR denial scenarios in medical billing. Plus, healthcare organizations can enhance claims submission efficiency by using pre-submission audits and checklists.

For instance, CombineHealth's Amy (AI Medical Coding Agent) can help flag coding errors in real-time before claims are processed and scrubbed for submission and reduce claim denials.

Similarly, denials due to incomplete patient information can be minimized through thorough eligibility verification processes.

Step 2: Detect and Classify Denials

Capture denials automatically through EDI 835 remittance advice files and categorize by payer, denial code, specialty, and claim type.

CombineHealth's AI revenue cycle analyst Taylor displays analytics dashboards showing both activity (claims placed, claims submitted, etc.) and outcomes (net collection rate, average days in A/R, etc.) in real-time.

.webp)

Step 3: Conduct Root Cause Analysis

Identify systemic causes—coding errors, missing documents, or payer rules. Assign specialized staff to handle coding, COB, or authorization denials separately.

Step 4: Correct and Resubmit

Fix soft denials immediately: correct CPT/ICD, attach missing documents, or revalidate authorization. For hard denials, initiate payer appeals with supporting evidence and reference numbers.

Step 5: Track and Escalate

Use denial tracking software to monitor resolution rates. Key denial KPIs to track include:

- Total denial rate (% of denied claims)

- Denials by payer (% and dollar value)

- First Pass Resolution Rate (FPRR)

- Average denial resolution time

- Denial write-off rate

Below is a demonstration of how CombineHealth AI-powered denial management agents help in getting the maximum reimbursement once a claim is denied:

Furthermore, escalate unresolved or recurring denials to payer relations or CFO review meetings. Also, conduct monthly audits to track recurring issues by department or payer.

Step 6: Train Your Staff

Regular training for billing and coding staff is vital for maintaining coding accuracy and preventing AR denials in medical billing. Help them keep up to date with payer rule changes, modifier updates, and new denial codes.

Additionally, bridge AR, medical coding, clinical documentation, and registration teams to share insights and reduce future denials.

.webp)

Strengthen Your AR Management Strategy

AR denial management sits at the intersection of revenue protection and financial stability.

By treating it as a strategic, data-driven discipline rather than a reactive cleanup function, RCM leaders and CFOs can dramatically improve both short-term liquidity and long-term margin health.

- Strong denial prevention = predictable cash flow

- Faster denial resolution = reduced AR days

- Data-driven denial insights = smarter payer strategy

Effective AR denial management requires a proactive approach to identify patterns and eliminate root causes of denial scenarios.

Ready to turn AR from a bottleneck into a growth engine? Book a demo with CombineHealth!

FAQs

What does AR days mean?

AR days (Accounts Receivable days) represent the average number of days it takes for a healthcare organization to collect payment after providing services. It’s a key measure of revenue cycle efficiency and cash flow health—fewer AR days indicate faster collections and better financial performance.

Regular audits and training for billing and coding staff are essential for maintaining coding accuracy and compliance, which directly helps reduce AR days and prevent claim delays.

What is a good AR day in medical billing?

A good AR day benchmark in medical billing typically ranges from 30 to 40 days for high-performing organizations.

Using technology can streamline billing processes, enhance AR management, and reduce errors in claims submission—allowing providers to maintain lower AR days and more predictable cash flow.

Additionally, clear communication with payers can also lead to quicker resolutions of denied claims and stronger payer relationships, further improving AR performance with solutions that help reduce denials.

How do claim denials lead to AR issues in healthcare?

Claim denials occur when an insurance company refuses to cover the expenses for healthcare services provided to a patient. One of the most common reasons for claim denials is incorrect patient data, such as errors in patient information or insurance details. These denials delay reimbursement, increasing AR days, disrupting cash flow, and creating bottlenecks in the revenue cycle.

How do you calculate AR days in RCM?

AR days are calculated by dividing Total Accounts Receivable by Average Daily Charges. This formula reveals how long, on average, it takes to collect outstanding revenue.

.webp)